Use the correct VAT number field

Magento has two possible Tax/VAT number fields. The first one is the "Tax/VAT, code: taxvat" field, assigned to the customer entity. The field name is a bit misleading, as it is intended to be used as a "Tax Number" field only. Many countries provide a unique personal tax number, which can be saved in that field.

Since Magento 1.7 the field "VAT number, code: vat_id" was introduced, which allows the usage as a real VAT number field. It is assigned to the customers address entity, for VAT calculation. Because the VAT calculation is nearly always based on the shipping address, this is the field which should be used for EU VAT numbers, which are issued for companies.

If you want to use our EU VAT Enhanced Magento extension, the only supported field is the "VAT number, code: vat_id" field.

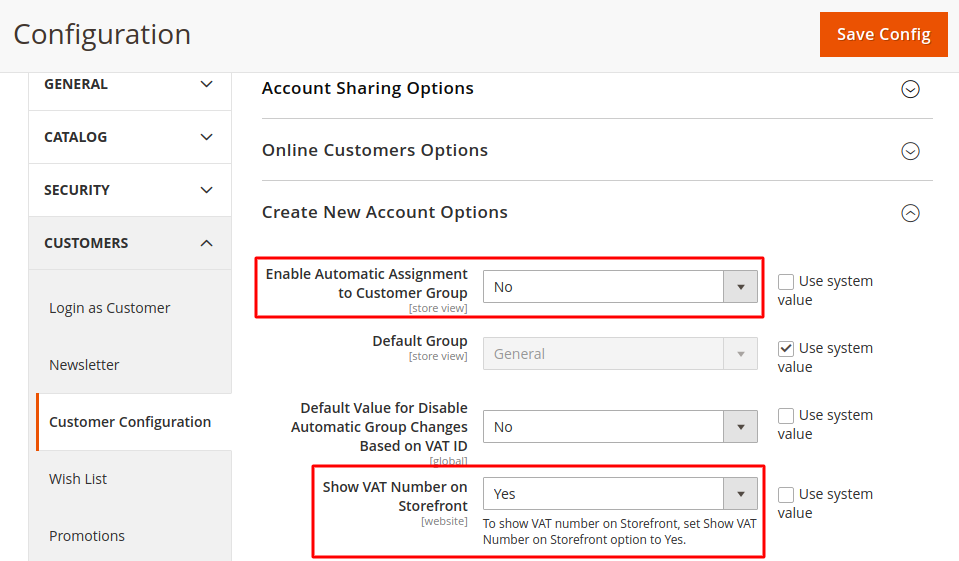

To enable this field, please go to "Stores -> Configuration -> Customer Configuration", and within "Create New Account Options" set "Show VAT Number on Frontend" to "Yes":

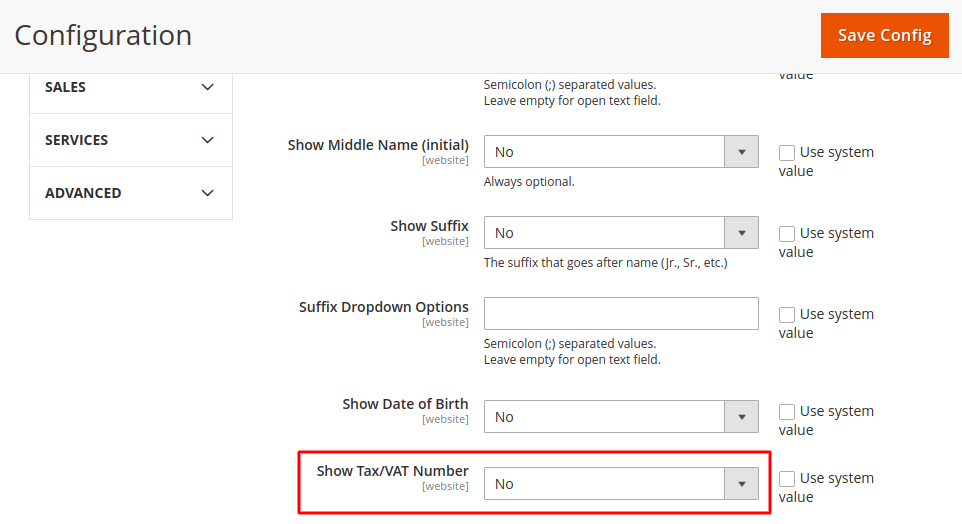

We recommend to disable the account based field "Tax/VAT, code: taxvat" to prevent misunderstanding of the customer. To disable the field, also within the Customer Configuration settings at "Name And Address Options", set "Show Tax/VAT Number" to "No".