Disclaimer: We are no tax advisors so the information below may be incorrect or incomplete or not applicable in your country or to you.

If your company supplies products or provides services to consumers in other EU countries, there is a high likelihood that you will need to comply with the new regulations around the One-Stop-Shop procedure. One of the other requirements is that you have delivered at least €10,000 net worth of goods to other EU countries in the past.

If this applies to you, you will probably also have to calculate the respective tax rate of the country to which the delivery is made. We assume that you already have existing tax rules in your Magento installation and therefore simply need to adjust the tax rates.

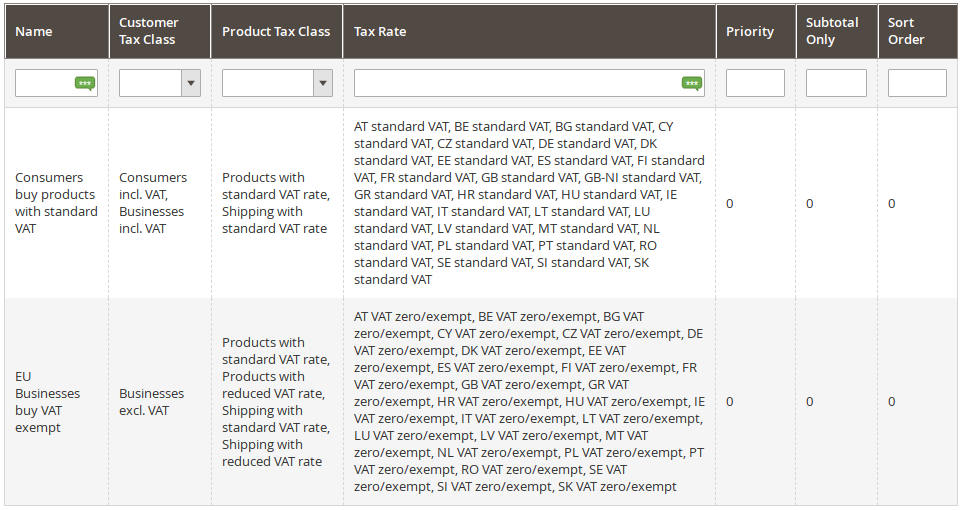

The most simple VAT setup could look like this:

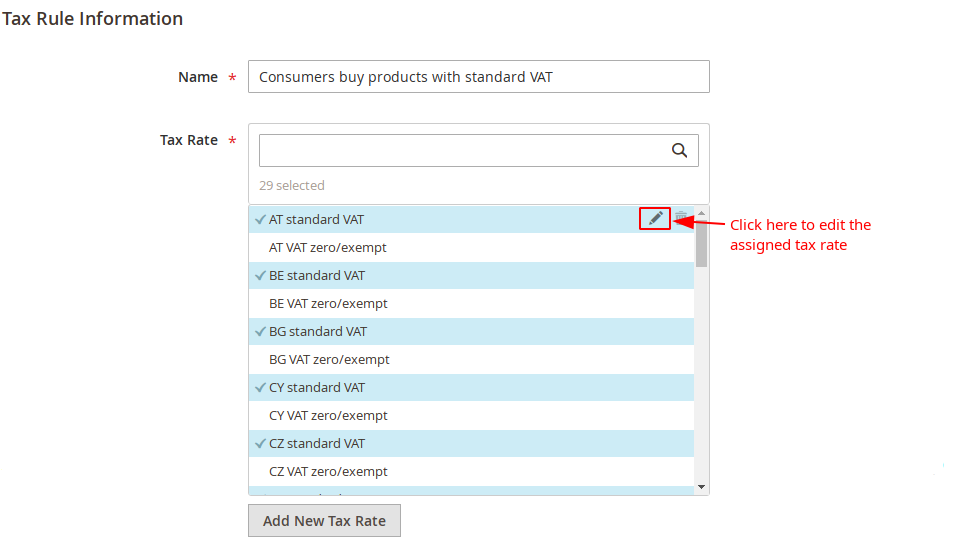

One quick way to change the rates is to edit your tax rule. All assigned tax rates are visible and can be changed.

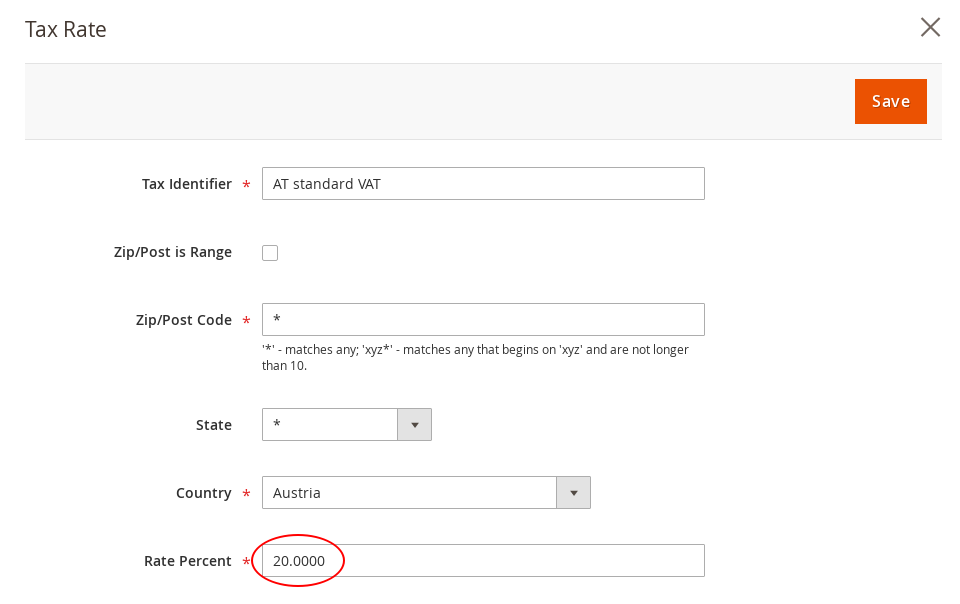

Then just change the rate to match the countries rate, instead of your domestic rate.

You will need to set the tax rate percentage for each country accordingly. Currently these are the valid tax rates for each EU country for 2021:

| Country | ISO Code | Standard VAT rate |

|---|---|---|

| Austria | AT | 20 % |

| Belgium | BE | 21 % |

| Bulgaria | BG | 20 % |

| Cyprus | CY | 19 % |

| Czechia | CZ | 21 % |

| Germany | DE | 19 % |

| Denmark | DK | 25 % |

| Estonia | EE | 20 % |

| Greece | GR | 24 % |

| Spain | ES | 21 % |

| Finland | FI | 24 % |

| France | FR | 20 % |

| Croatia | HR | 25 % |

| Hungary | HU | 27 % |

| Ireland | IE | 23 % |

| Italy | IT | 22 % |

| Lithuania | LT | 21 % |

| Luxembourg | LU | 17 % |

| Latvia | LV | 21 % |

| Malta | MT | 18 % |

| Netherlands | NL | 21 % |

| Poland | PL | 23 % |

| Portugal | PT | 23 % |

| Romania | RO | 19 % |

| Sweden | SE | 25 % |

| Slovenia | SI | 22 % |

| Slovak Republic | SK | 20 % |

| United Kingdom | UK | 20 % |

United Kingdom is still in this list because of Northern Ireland is treated as it would be an EU country.

After you did change all the rates, you have configured your store to calculate the VAT rate of each EU country.