Magento automatic VAT Configuration

It should be ensured that your Magento instance is ideally set up to meet the requirements for VAT calculation. To achieve this, we recommend a standard configuration as offered by our optional automatic setup. This installs the most important tax rules in Magento, but overwrites the existing configuration. The extension can therefore also be easily integrated into an existing setup.

Automatic setup

The setup will recognize the domestic country based on the entered values and set them together with the own VAT ID in the Magento standard configuration. Furthermore, tax rules are created to calculate the necessary tax rates for different combinations of product and customer tax classes

After the successful installation of the module, a message appears in the Magento admin area. To run the initial setup, follow the link. If you have already completed the configuration for the VAT calculation yourself, click on the "Skip" link

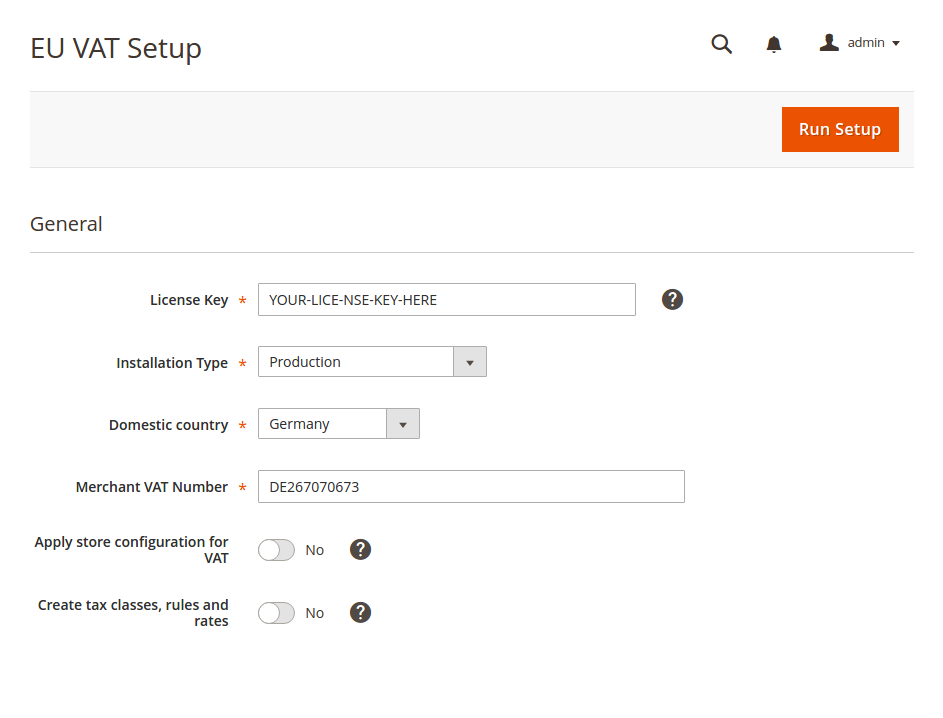

Now fill in the values with your data on the setup page.

Explanation of the individual fields

- License Key: You can obtain the license key via your customer account in the "Downloads and license key" area. Please use the same license key for all installations (i.e. in all developer instances, staging and test environments as well as the production instance)

- Domestic Country: Please select the country in which you are headquartered for tax purposes. This defines the domestic country and is set accordingly in Magento

- Merchant VAT Number: Please enter your own VAT ID here. This will be used for requests to the respective audit interface

- Apply store configuration for VAT: With this switch, the setup routine will set certain settings in the Magento configuration. You can see which values are set in the following table

| Store config path | Value |

|---|---|

general/country/default

|

Is set to the selected country |

general/store_information/merchant_vat_number |

Your own VAT ID is saved in this field. |

tax/classes/shipping_tax_class |

Is set to the new standard shipping tax class |

tax/calculation/based_on |

Is set to the value "shipping address" in order to be able to calculate the tax rates of the respective country of delivery |

customer/create_account/auto_group_assign |

The most important setting for compatibility with our module. "No" is set here to deactivate the VAT ID check and customer group assignment contained in Magento. |

customer/create_account/vat_frontend_visibility |

So that the input field for the VAT ID is generally visible in the frontend on the customer side, the value "Yes" is stored here. |

customer/address/taxvat_show |

To avoid confusion with the different fields for tax numbers in Magento, the value is set to "No". The Tax/VAT field cannot be used for EU VAT IDs and is intended for personal or national tax numbers. |

- Create tax classes, rules and rates: This switch causes all existing tax rules, rates and classes to be overwritten with our default setup. If you have already created the tax rules yourself and the required tax classes and rates already exist, you can also use these. It is not absolutely necessary to use our standard setup

- Tax class mapping: In order to determine the intended use of the various tax classes, it is necessary to let the setup routine know which old values correspond to the new ones

Now you can click on [Run Setup] to execute the setup. After the setup has run successfully, you will be redirected to the configuration page to adjust further settings if necessary. You will find an explanation of the individual settings in the next section.

Apply store configuration for VAT or Create tax classes, rules and rates please continue with the manual configuration. Otherwise you can proceed with the configuration of the extension There are no products matching the selection.