Configure VAT manually in Magento

If you do not wish to use our standard setup or if you have already configured Magento to use VAT, or simply want to check your configuration for compatibility, please follow the individual instructions and explanations below.

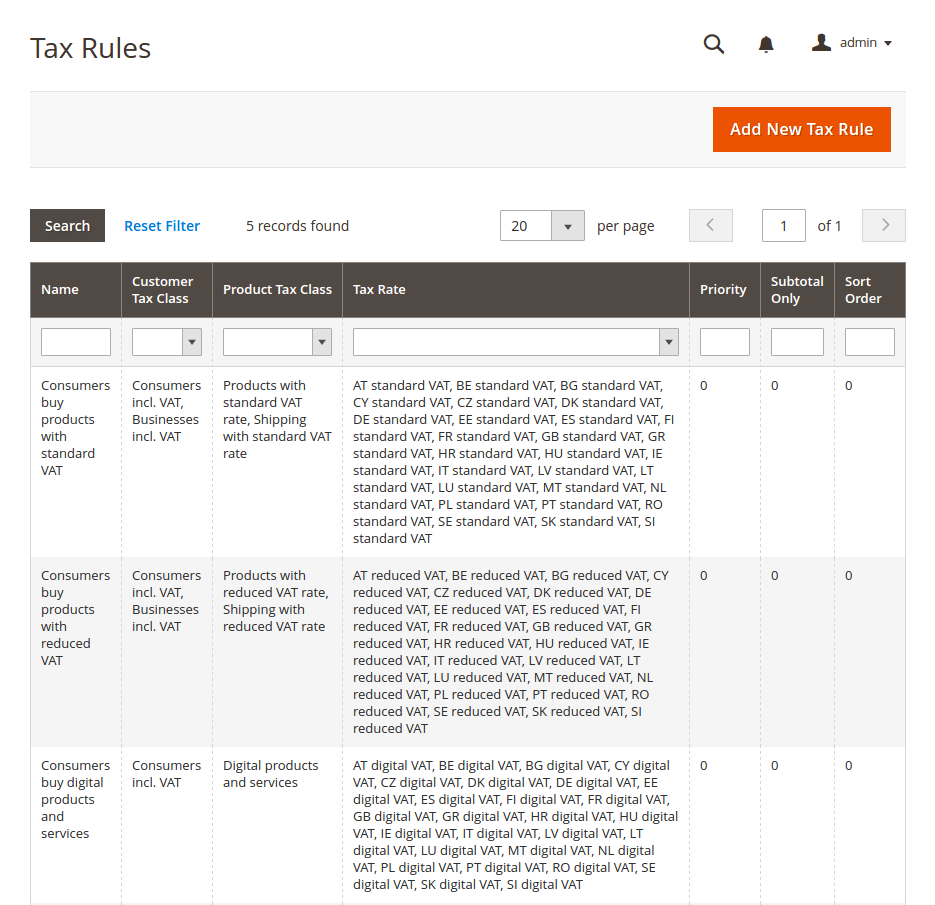

Create tax rules

To calculate VAT for the EU in different scenarios, it is necessary to create suitable tax rules. In most cases, you will need a rule for each product tax class you use, e.g. products with normal, reduced or even heavily reduced tax rates. For each rule, you then assign the applicable tax rate for each country you ship to.

To create tax rules, please navigate to Stores → Tax Rules and create tax rules as shown below. If, for example, you only trade in products to which the standard tax rate applies, you do not need to create a rule for products with a reduced tax rate.

Explanation of the tax rules

As an example, let's imagine that the country is the Netherlands. The standard tax rate in the Netherlands is 21%.

Consumers buy products at the standard tax rate: this is the basic standard rule needed to calculate the VAT. For products and shipping at the standard rate, 21% is calculated for each country listed in the tax rates section. For the tax rates, create a tax rate for each EU country with a rate of 21% - or if you need to apply OSS, with the country's rate, for example 19% Germany, 20% France etc.

(Optional) Consumers buy products with a reduced tax rate: If you also sell products with a reduced tax rate, create this rule and create a tax rate for each EU country with the respective reduced tax rate.

EU companies buy VAT-free: The last rule applies to EU companies with a valid VAT ID or for other cases in which no tax is charged. Assign the customer tax class "Company without VAT" together with all possible product and shipping tax classes. It is not absolutely necessary to create an additional tax rate with 0% for each country, as if no tax rate is stored for the country, Magento will not calculate any tax. However, it can be helpful if the detailed tax rate can be displayed in the list of totals. We therefore recommend creating a tax rate of 0% for all EU countries and assigning it in this rule.

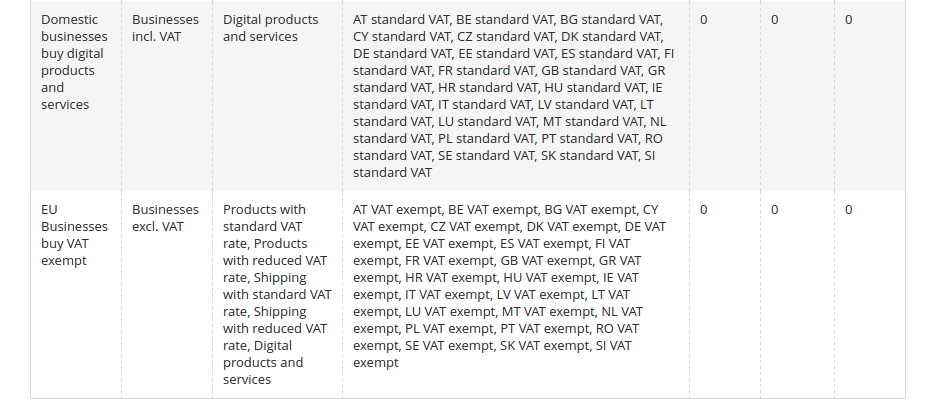

Prepare customer groups

The customer group assignment is completely optional with our module. It is not necessary to assign customers to special "tax-free" groups. This gives you complete freedom in terms of customer groups and allows you to use them more effectively, for example for different discount levels or similar. The module takes care of applying the correct customer tax class in every case, regardless of the tax class selected for the customer group. If you would still like to use the customer groups for this, this is of course also possible

Navigate to Customers → Customer Groups.

We recommend the following customer groups as an example, or assignments can be made for the following groups based on the customer's billing address. If our module assigns customer groups, then always on the basis of the customer's standard billing address.

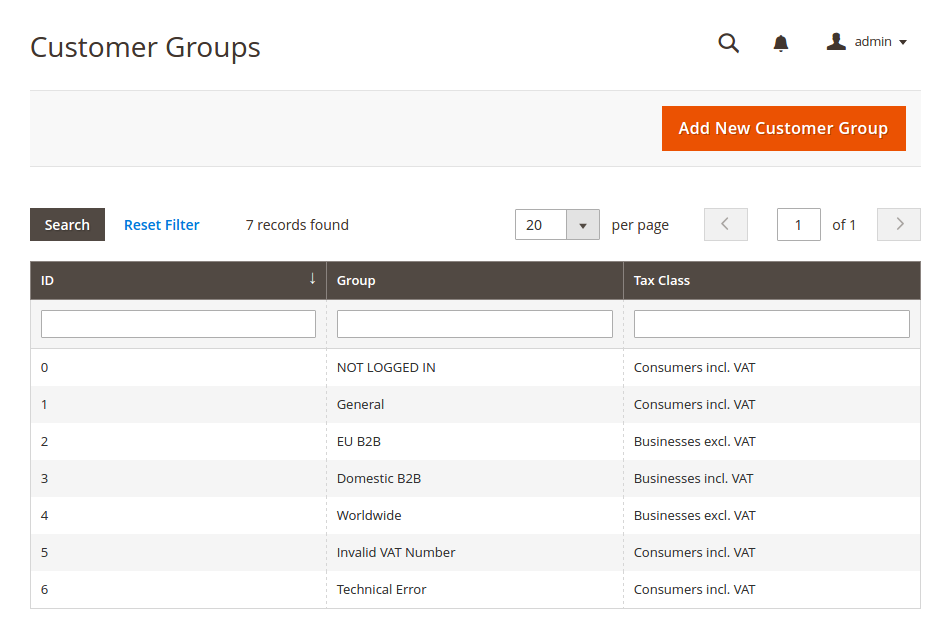

Settings for the configuration in Magento

Since Magento itself supports a rudimentary VAT ID check, there are various setting options within the configuration. We will go through the most important settings below.

Activate the field for the VAT ID

- Navigate to

Stores → Configuration → (Customers) Customer Configuration - Under

Create New Account Options, set the settingEnable Automatic Assignment to Customer GrouptoNoto deactivate the check included in Magento Core. This is important as otherwise there will be conflicts with our module - For

Create New Account Options, set theShow VAT Number on Frontendsetting toYes - For

Create New Account Options, set theDefault Groupsetting, for example toGeneral - For

Name and Address Options, deactivate theShow Tax/VAT Numbersetting withNo

Set the tax calculation method

- Navigate to

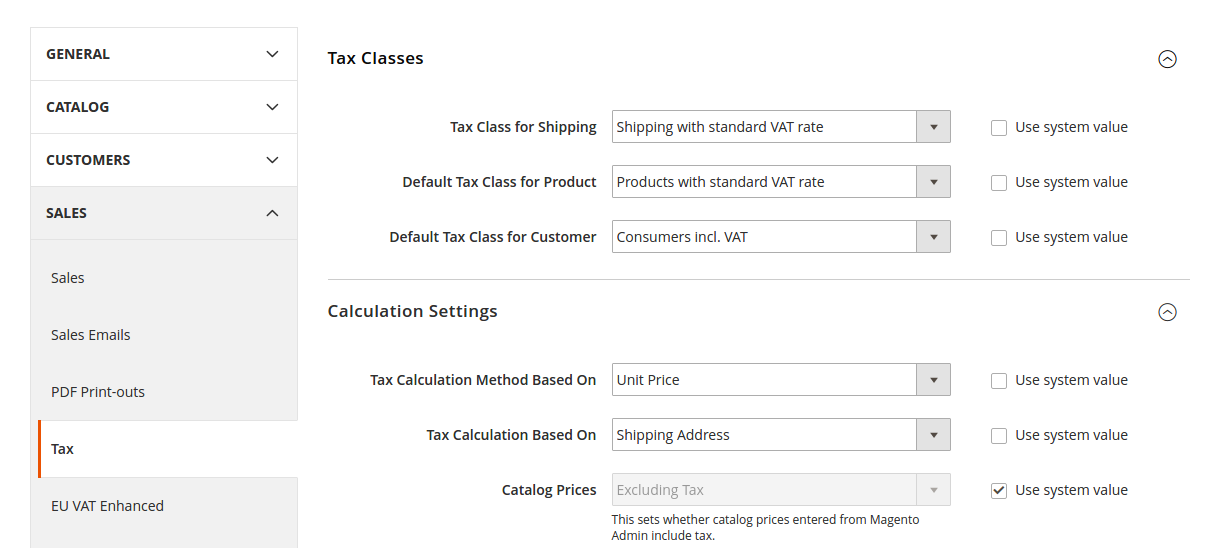

Stores → Configuration → (Sales) Tax - For

Tax Classes, set theTax Class for Shippingsetting toShipping with standard VAT rate - For

tax classes, set the"Default Tax Class for Product"setting to"Products with standard VAT rate" - For

tax classes, set the setting"Default Tax Class for Customer"toConsumers incl. VAT - For

Calculation Settings, set the"Tax Calculation Based On"setting toShipping Address - For

Default Tax Destination Calculation, set theDefault Countrysetting toGermany

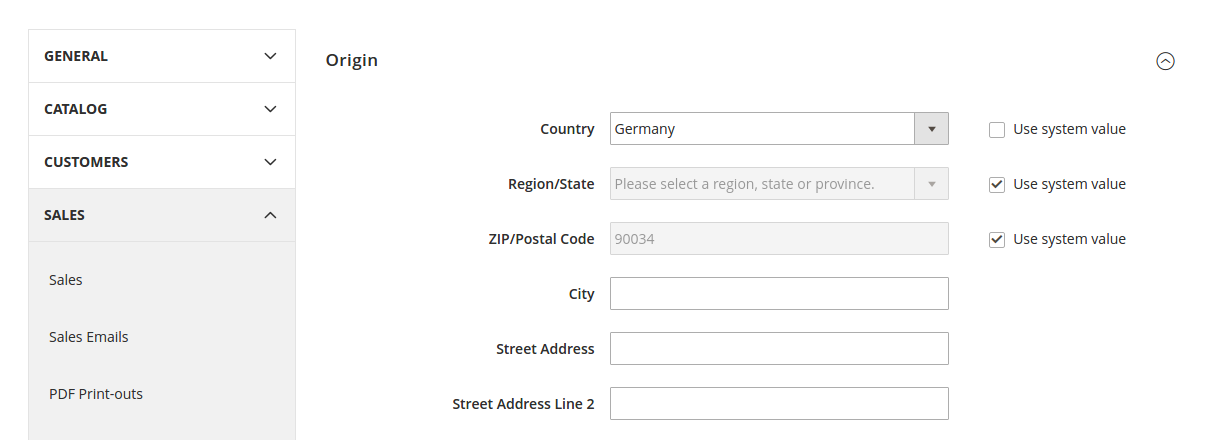

Setting the shipping country of origin

This defines the country of origin (Germany) from which you ship the goods.

- Navigate to

Stores → Configuration → (Sales) Shipping Settings - Set the domestic country

This completes the most important settings and you can continue with the configuration of the module.