Configuration Guide

Most seller data is automatically pulled from General Configuration. All settings can be configured at Default, Website, and Store View levels. Contact information is optional but recommended for better communication.

Navigate to: Stores > Configuration > Sales > E-Invoicing

Configuration Sections

General Settings

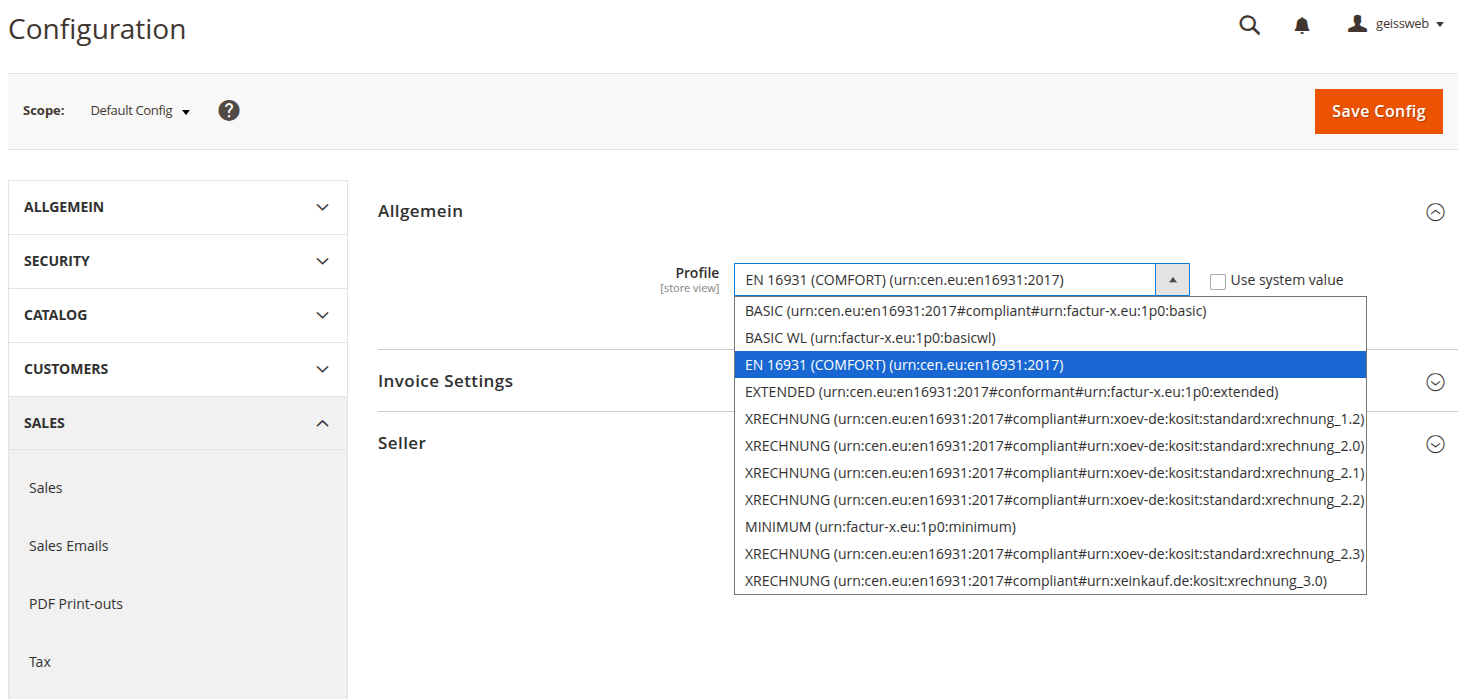

Profile

Select the profile to be used for creating electronic invoices

The extension offers various profiles for electronic invoices. Each profile defines a specific scope of structured data and is suitable for different use cases. We recommend the use of the BASIC or EN 16931 (COMFORT) profile.

MINIMUM

The MINIMUM profile contains basic information about the buyer and seller, the total invoice amount and the total sales tax. Only the buyer's reference can be specified at item level. A breakdown of the sales tax is not supported. It mainly serves as a booking aid.

BASIC

The BASIC profile is a subset of EN 16931-1 and can be used for simple VAT-compliant invoices. It provides the basic mandatory fields for legally valid electronic invoices.

BASIC WL

The BASIC WL profile (WL = Without Lines) does not contain any invoice items and therefore cannot map VAT-compliant invoices. However, it contains all the information at document level that is required for posting the invoice and therefore serves as a posting aid.

EN 16931 (COMFORT)

The EN 16931 profile (also known as COMFORT) fully maps the European standard EN 16931-1 and focuses on the core elements of an electronic invoice. It complies with the European standards for electronic invoices.

EXTENDED

The EXTENDED profile is an extension of EN 16931-1 to support more complex business processes. It is suitable for invoices with multiple deliveries/delivery locations, structured payment terms and additional information at item level to support stock management.

XRECHNUNG

The XRECHNUNG profiles (versions 1.2, 2.0, 2.1, 2.2, 2.3 and 3.0) are based on the CIUS XRechnung, which is maintained by KoSIT (Coordination Centre for IT Standards). They represent an extension of EN 16931-1 with its own business rules and the national German laws and regulations. These profiles are more specific than the EN 16931 (COMFORT) profile and are particularly relevant for the German public sector, where the XRechnung format is mandatory for electronic invoices to public clients.

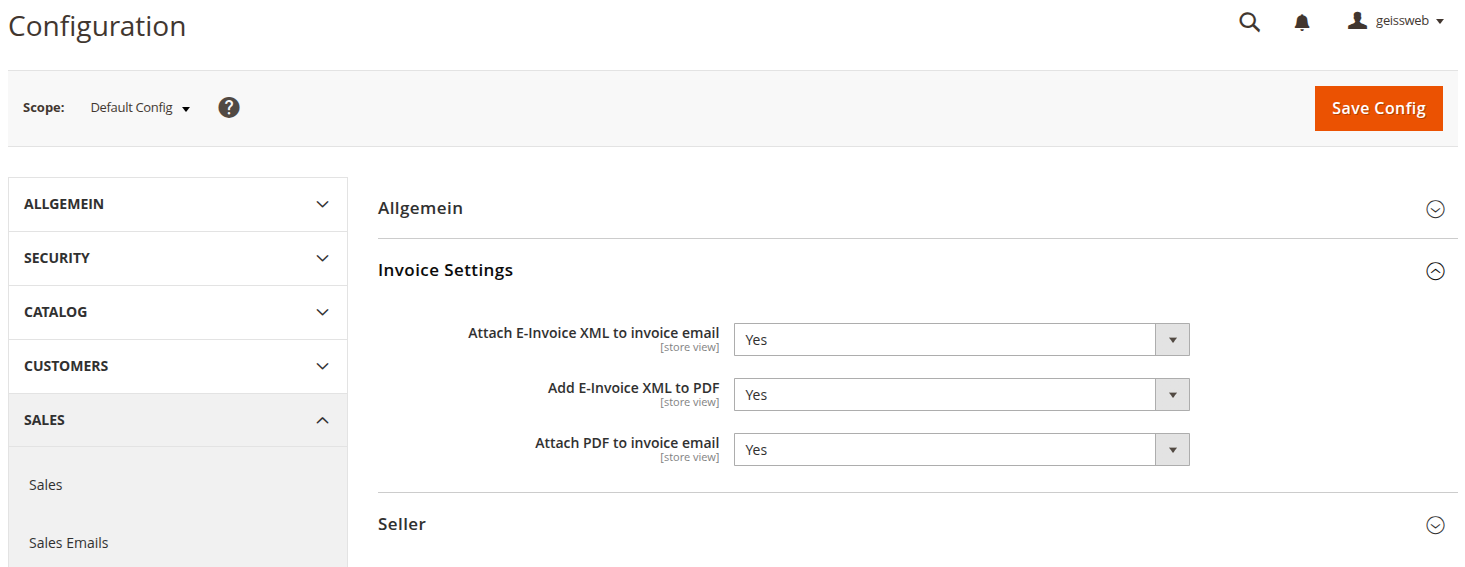

Invoice Settings

Attach E-Invoice XML to invoice email: Yes/No option to include XML in invoice emails

Add E-Invoice XML to PDF: Yes/No option to embed XML in PDF documents

Attach PDF to invoice email: Yes/No option to include PDF in invoice emails

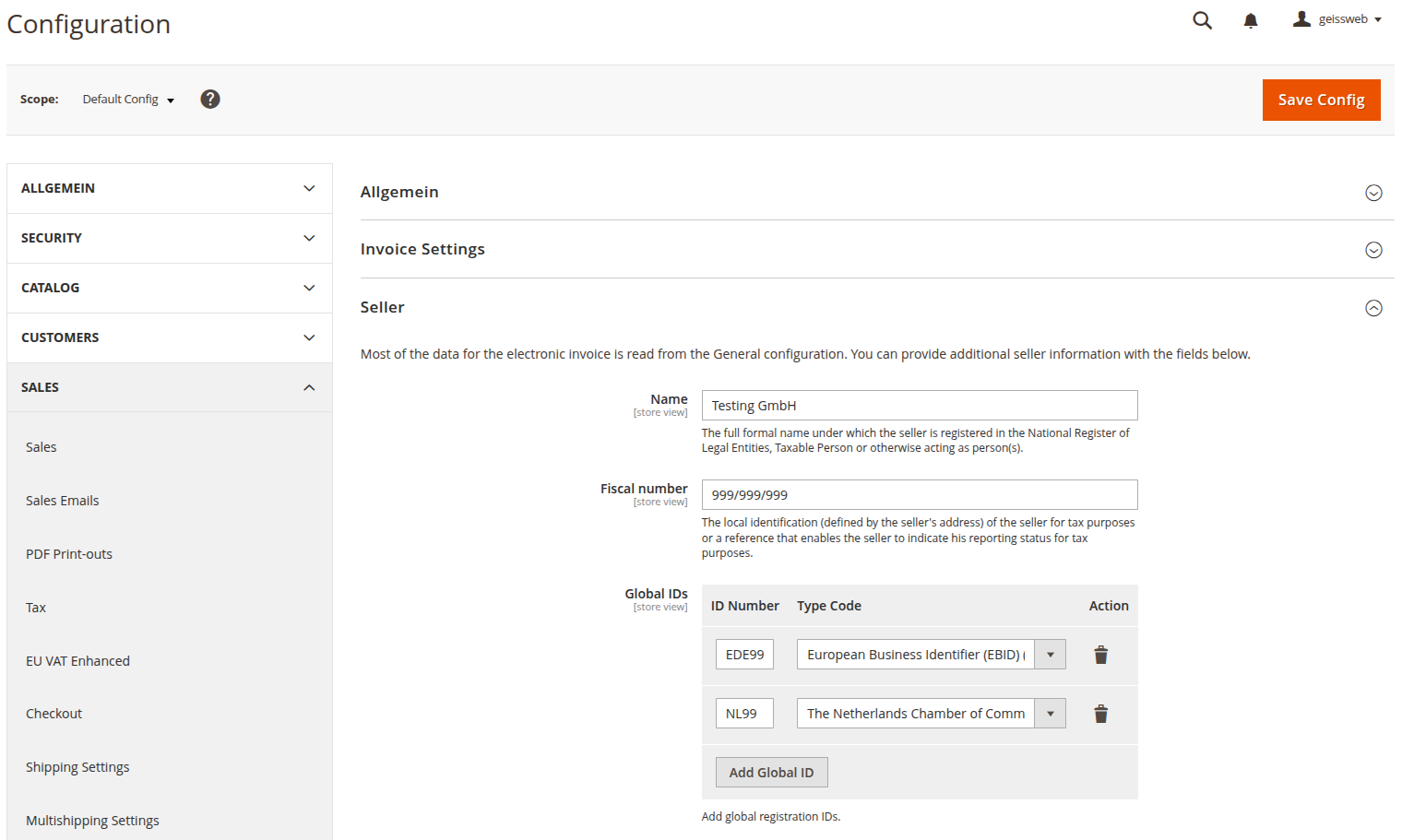

Seller Information

The seller section contains essential business information for electronic invoicing. The information is added in a structured way to the XML file.

Required Fields

Name: Full legal business name as registered in National Register. All other seller data is taken from Stores > Configuration > General.

Optional Fields

Fiscal number: Local tax identification number

Global IDs: Add multiple global registration identifiers

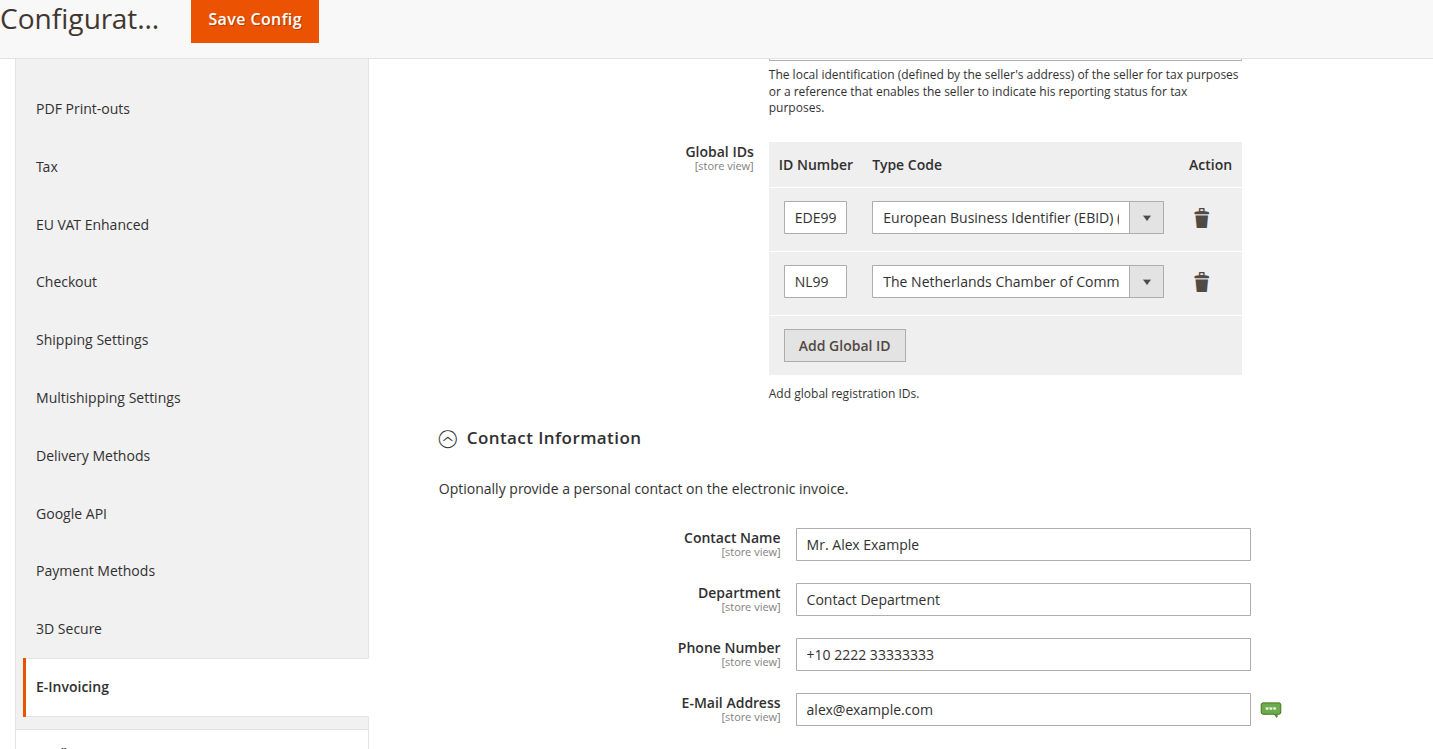

Contact Information

Optional contact details that appear on electronic invoices:

- Contact Name

- Department

- Phone Number

- Email Address