Sometimes, things may not work as planned, causing a bit of confusion. Here, we'll discuss some common issues to help you understand better:

Some orders calculate VAT even when a VAT number is provided

This situation may arise due to various reasons. Please check the following:

-

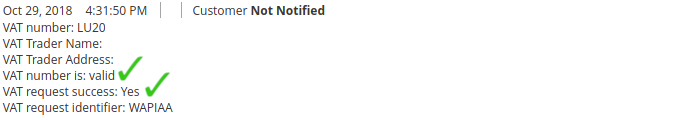

Are there validation details visible in the order comments?

Our module allows Magento to calculate VAT when any of the validation results are deemed invalid or incorrect:

VAT number validation result as order comment -

Does the VAT number's country prefix match the shipping address country?

If the country information does not match, our module allows Magento to apply VAT to the order. -

For registered customers: are there additional validation details saved in the customer address record (e.g., VAT is valid, VAT request successful) when you edit the customer address in the admin area?

Our module uses validation details from the address data to determine whether Magento should apply VAT to the order.

If the reasons above do not apply to your issue, kindly open a new support ticket from your customer account.

Tax rate import fails with "Invalid file upload attempt" error

If you're facing this issue, it's likely due to a mismatch between the CSV file headers and the store views of your Magento installation. Here's how you can fix it:

- Open your base import file in a text editor.

- Navigate to “Sales → Tax → Import/Export Tax Rates”, click on [Export Tax Rates], save the file to your hard disk, and open it with a text editor.

- Replace the first line of your base file with the first line from the file exported from your Magento installation. The exported file should include your store views, which is necessary for proper file import.